Condo Insurance in and around BROOKLYN

Here's why you need condo unitowners insurance

Protect your condo the smart way

Your Search For Condo Insurance Ends With State Farm

With the variety of condo insurance options to choose from, you may be feeling overwhelmed. That's why we made choosing State Farm easy. As one of the leading providers of condo unitowners insurance, you can enjoy remarkable service and coverage that is competitively priced. And this is not only for your unit but also for your personal belongings inside, including things like videogame systems, linens and clothing.

Here's why you need condo unitowners insurance

Protect your condo the smart way

Safeguard Your Greatest Asset

It's no secret that life is full of surprises, which is all the more reason to be prepared for the unexpected with condo unitowners insurance. This can include instances of liability or covered damage to your unit from water damage, a windstorm or an ice storm.

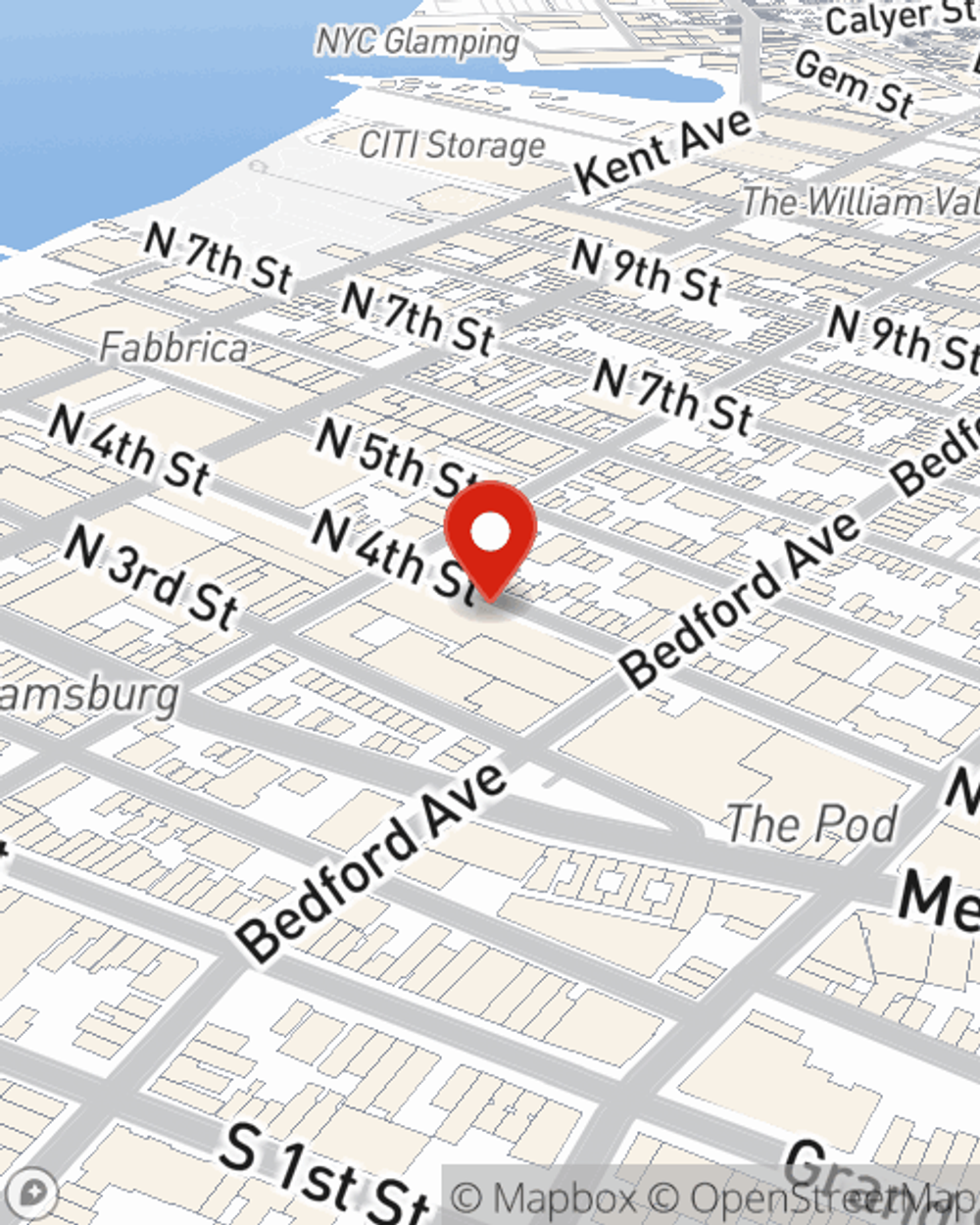

As a value-driven provider of condo unitowners insurance in BROOKLYN, NY, State Farm helps you keep your home protected. Call State Farm agent Carl Ferraro today for a free quote on a condo unitowners policy.

Have More Questions About Condo Unitowners Insurance?

Call Carl at (718) 576-3710 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Carl Ferraro

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.